Introduction: When Tax Services Go Silent

Tax season is stressful enough without your tax advisor suddenly going quiet. Unfortunately, many taxpayers and businesses experience the frustration of hiring a professional only to be met with silence, delays, or half-baked answers. An unresponsive tax service doesn’t just waste your time—it can cost you money, deductions, and even put you at risk with the IRS.

So, why does this happen, and more importantly, what can you do when your tax professional leaves you in the dark? Let’s break it down.

Table of Contents

Why Tax Services Become Unresponsive

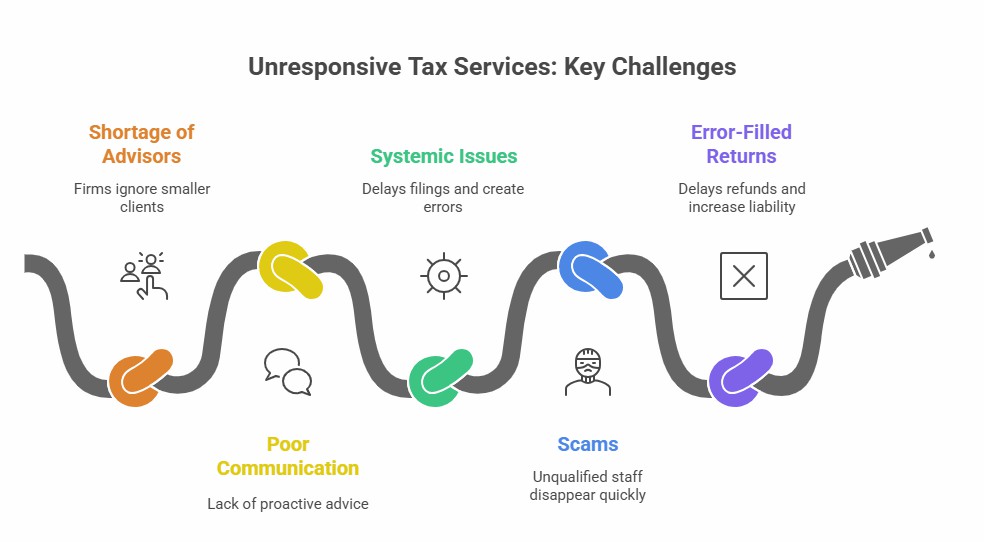

An unresponsive tax service can stem from many factors, ranging from systemic issues to outright scams. Here are the most common reasons:

- Shortage of Qualified Advisors

Small businesses in particular struggle to find certified professionals. With demand high and supply low, some firms ignore new or smaller clients, leaving them feeling abandoned. - Poor Communication & Lack of Proactive Advice

Some advisors fail to communicate important strategies like Section 179 deductions, multi-state tax considerations, or tax planning tips that save money. This lack of engagement creates frustration and missed opportunities. - Systemic and Process Issues

Outdated software, rigid processes, or unreliable systems within firms can delay filings and create errors, making clients feel neglected. - Scams and Low-Quality Services

Beware of tax relief companies promising “guaranteed settlements” or “quick fixes.” Many employ unqualified staff, charge hefty upfront fees, and disappear when problems arise. - Error-Filled Returns

Incomplete or incorrect returns can delay refunds and even increase your liability—another sign of poor service. - Situations Beyond Control

In rare cases, emergencies like illness can cause delays. While understandable, professionals should have systems to notify clients and ensure deadlines are met.

The Risks of Ignoring an Unresponsive Tax Service

Leaving an unresponsive tax preparer unchecked can be costly:

- Missed Deadlines: Late filings often mean penalties and interest.

- Lost Deductions: Missed credits increase your tax bill unnecessarily.

- Exposure to Scams: Fraudulent firms can drain your wallet and damage your credit.

- Stress & Business Disruption: Financial uncertainty adds emotional strain, especially for small businesses.

What to Do If Your Tax Service Is Unresponsive

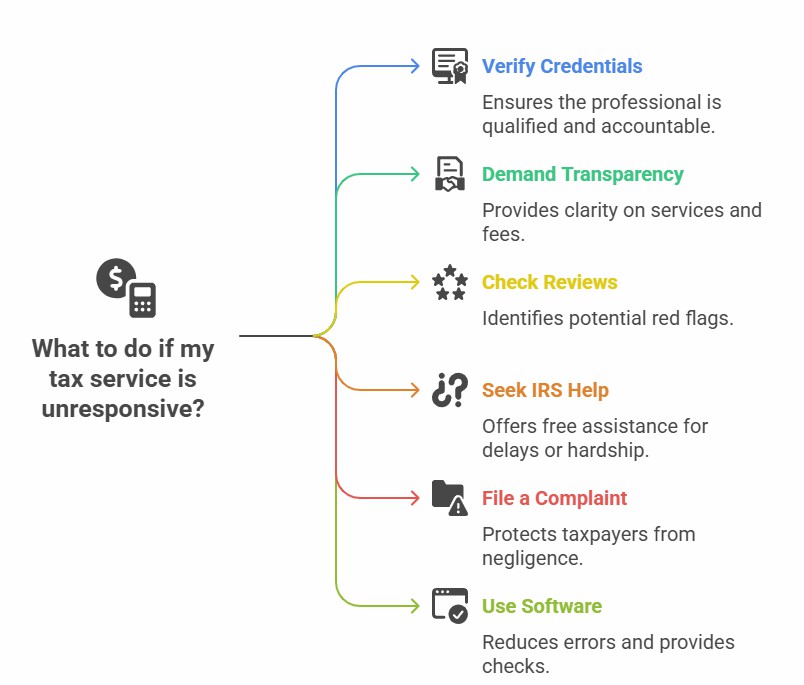

The good news? You’re not powerless. If your tax advisor goes silent, here’s what to do:

- Verify Credentials

Ask for proof that they’re a CPA, Enrolled Agent (EA), or licensed tax attorney. Qualified professionals are accountable to regulatory bodies. - Demand Transparency

Never settle for vague agreements. Legitimate firms provide written contracts outlining services, fees, and deadlines. - Check Reviews & References

Search for past client experiences. Repeated complaints about responsiveness or ethics are red flags. - Seek Help from the IRS Taxpayer Advocate Service (TAS)

If the IRS itself is unresponsive, the Taxpayer Advocate Service provides free assistance in cases of delays or financial hardship. - File a Complaint with the IRS

If your preparer is negligent, you can file a complaint directly with the IRS. This step can help protect both you and other taxpayers. - Educate Yourself & Use Trusted Software

Reliable platforms like TurboTax or other IRS-recognized software reduce errors and provide built-in error checks. - Develop Feedback Loops

For tax professionals managing clients, establishing clear communication and feedback systems ensures clients don’t feel abandoned.

How to Avoid Bad Tax Services in the Future

Preventing the problem is always better than fixing it. Here’s how to protect yourself:

- Watch for Red Flags: High-pressure sales tactics, unrealistic promises, or lack of transparency are major warnings.

- Get It in Writing: Insist on detailed contracts before handing over sensitive information.

- Build Relationships: Stick with reliable advisors who provide proactive advice year-round.

- Use Trusted Resources: Check the IRS directory of credentialed preparers or professional associations before hiring.

Useful Resources – unresponsive tax service

For additional guidance, here are authoritative resources you can trust:

- IRS Taxpayer Advocate Service

- IRS Complaint Process for Tax Preparers

- Seattle Legal Services: Avoid Tax Relief Scams

- TurboTax: Top Reasons Refunds Get Delayed

- FBR Taxpayer Satisfaction Survey 2023

- Does Odoo Support UAE VAT

Conclusion: Take Back Control of Your Taxes

If you’re dealing with an unresponsive tax service, remember: you have options. From verifying credentials and filing complaints to seeking help from the Taxpayer Advocate Service, you don’t have to stay stuck.Tax advisors are supposed to serve you—not the other way around. If yours is failing, take action today to protect your finances, your peace of mind, and your future.