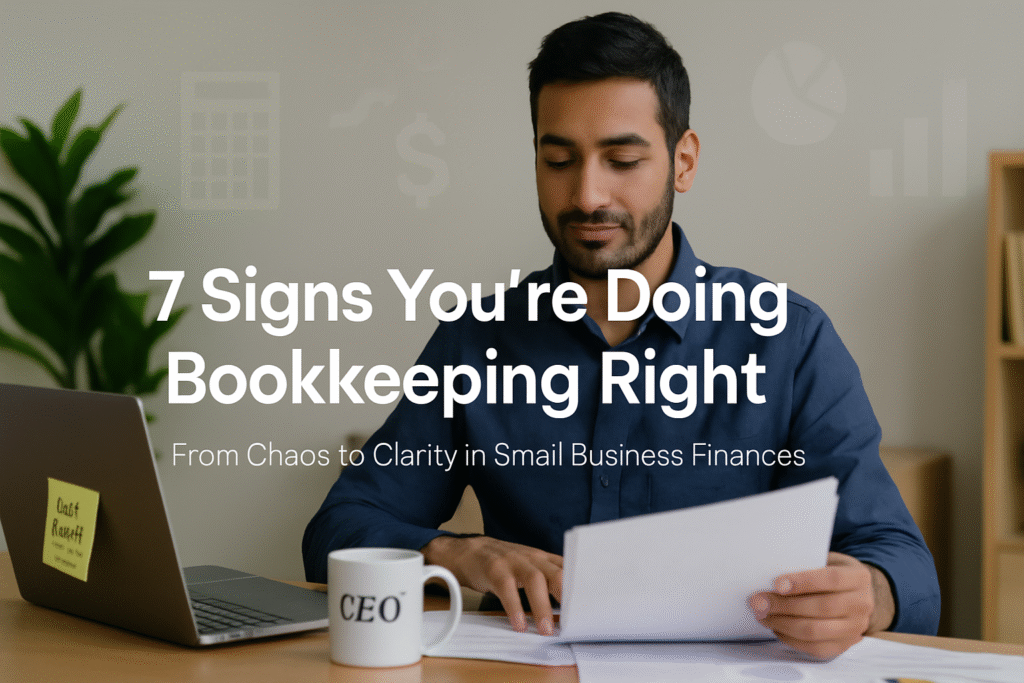

Let’s Start With the Real Question: Are You Actually Bookkeeping, or Just Guessing?

If you’ve ever sat back and asked, “Am I doing this bookkeeping thing right?”—congrats, you’re already doing better than most. Too many small business owners treat bookkeeping like a dusty box of receipts, instead of what it really is: the heartbeat of smart business.

In this guide, we’ll break down how to know if your bookkeeping for small businesses is on point, where you might be slipping, and how to tighten things up—without turning into a full-time accountant.

Table of Contents

What Bookkeeping Really Means (No Jargon, We Promise)

Bookkeeping is the daily act of tracking and recording your business’s financial transactions—sales, purchases, invoices, receipts, bills, payments, and everything in between. It’s how you get the answers to questions like:

- “How much did I make last month?”

- “Can I afford to hire someone?”

- “Where is my money going?”

In short, bookkeeping for small businesses is how you know your business is healthy—without relying on vibes.

7 Signs You’re Doing Bookkeeping Right

1. Your Records Are On Point—And On Time

You’re logging every transaction as it happens (or at least on a regular schedule). No guesstimates. No mental math. Just clean, accurate data.

Why it matters: Timely recordkeeping gives you real-time visibility over your cash flow—one of the key pillars of bookkeeping for small businesses.

2. You Reconcile Your Bank Statements (Yes, Monthly)

You cross-check your bank statements with your books every month. Why? Because things get missed. Or double entered. Or fraudulently spent.

Pro tip: Bank reconciliation is a non-negotiable in any bookkeeping best practices checklist.

3. You’ve Got a System—And You Stick to It

Maybe it’s QuickBooks. Maybe it’s Excel. Maybe it’s some high-powered accounting software for bookkeeping. Doesn’t matter, as long as you’re consistent.

Consistency prevents chaos when tax season hits or when you need to pull reports for investors, loans, or planning.

4. Business and Personal? Totally Separate.

If you’re still using one bank account for both business and personal expenses… stop. Today. Right now.

Mixing finances is one of the biggest bookkeeping mistakes to avoid. It makes tax filing a nightmare and muddies financial clarity.

5. You Actually Review Your Financial Reports

You’re regularly checking your:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

- Accounts Receivable/Payable Aging Reports

These aren’t just numbers—they tell the story of your business. And they’re the foundation of good bookkeeping for small businesses.

6. You Use One Accounting Method Across the Board

Cash or accrual—pick one and ride with it. Switching back and forth = inconsistent records and tax trouble.

7. You Know When It’s Time to Call a Pro

You recognize your limits. You either hire a bookkeeper, consult with an accountant, or use outsourced bookkeeping services when the books get too complex.

There’s no badge for doing it all alone. There’s only stress—and missed deductions.

Bookkeeping Best Practices That Most Small Businesses Skip

Even if you’re not an expert, you can still get 90% of the way there by following a few smart rules:

- Set aside regular time every week just for bookkeeping

- Use digital tools with bank feeds and auto-categorization

- Keep ALL records: receipts, invoices, bank statements

- Budget for taxes monthly—not just in April

- Do a quarterly review to clean up your books and adjust your strategies

This is what separates DIY disaster from effective bookkeeping for small businesses.

Avoid These Common Bookkeeping Mistakes (They Hurt, Trust Us)

- Mixing business and personal expenses

- Not backing up your financial data

- Letting receipts and invoices pile up

- Poor expense categorization

- Not using automation

- Only looking at numbers during tax season

A great bookkeeping tip: Build habits that make these mistakes impossible.

Still Unsure? Ask Yourself These Questions:

- Can I explain my cash flow in under 60 seconds?

- Do I know how much I owe—and how much I’m owed—right now?

- Could I confidently hand over my books to an accountant today?

- Are my taxes prepped in advance, not panicked last-minute?

If you answered “No” to any of these, don’t stress. It just means it’s time to level up your bookkeeping for small businesses.

Tools & Resources to Make It Easier

No need to reinvent the wheel. Start with these highly recommended tools:

- QuickBooks Online – great all-in-one solution

- Xero – sleek interface, popular with startups

- Wave – free and effective for basic needs

- Zoho Books – ideal for automation

- Excel Templates – for the spreadsheet-inclined

And dive deeper with these must-reads:

- Bookkeeping 101 – BDC

- 10 Bookkeeping Best Practices – Shopify

- 12 Actionable Tips – Bill.com

- How Do I Know If My Bookkeeping Is Right? – BB Books

When to Hire a Bookkeeper (It’s Probably Sooner Than You Think)

If:

- You’re behind on your books

- You can’t make sense of reports

- You’re spending more time on books than on your business

…it’s time to bring in help. Hiring a pro for your small business bookkeeping is an investment in clarity, confidence, and compliance.

Final Verdict: So… Are You Doing It Right?

If you:

- Keep accurate records

- Reconcile monthly

- Review reports

- Stay organized

- Know when to ask for help

Then yes, you’re doing bookkeeping for small businesses exactly right.

If not? You’re not far off. You’ve got this blog. You’ve got the tools. And now, you’ve got the clarity to clean things up.

So go on—bookkeep like a boss. 💼

FAQs

Q: What is bookkeeping and why is it important for small businesses?

A: It’s how you track your money and understand your business’s performance—critical for taxes, planning, and growth.

Q: Can I do my own bookkeeping for a small business?

A: Absolutely. Just follow the right bookkeeping best practices, use tools, and know your limits.

Q: What’s the best software for small business bookkeeping?

A: QuickBooks, Xero, Wave, and Zoho Books are top options.

Q: When should I outsource my bookkeeping?

A: If you’re overwhelmed, making mistakes, or growing fast—it’s time.