Introduction

For small businesses and freelancers, managing finances can feel like juggling knives — one wrong move and things get messy. Bookkeeping with Excel offers a budget-friendly, customizable way to track payments, sales, expenses, and more without paying for expensive accounting software.

In this guide, we’ll walk you through Excel bookkeeping steps, explain the pros and cons of Excel bookkeeping, and show you a simple bookkeeping example you can start using today.

Table of Contents

What is Bookkeeping with Excel?

Bookkeeping with Excel is the process of using Microsoft Excel spreadsheets to record and manage your company’s financial transactions. It’s a form of manual bookkeeping in Excel, where you create or download a bookkeeping template tailored to your needs.

With Excel, you can track:

- Sales and income

- Expenses and purchases

- Cash flow

- Profit and loss

For many, Excel is the first stop before moving to software like QuickBooks or Odoo — especially for small business bookkeeping.

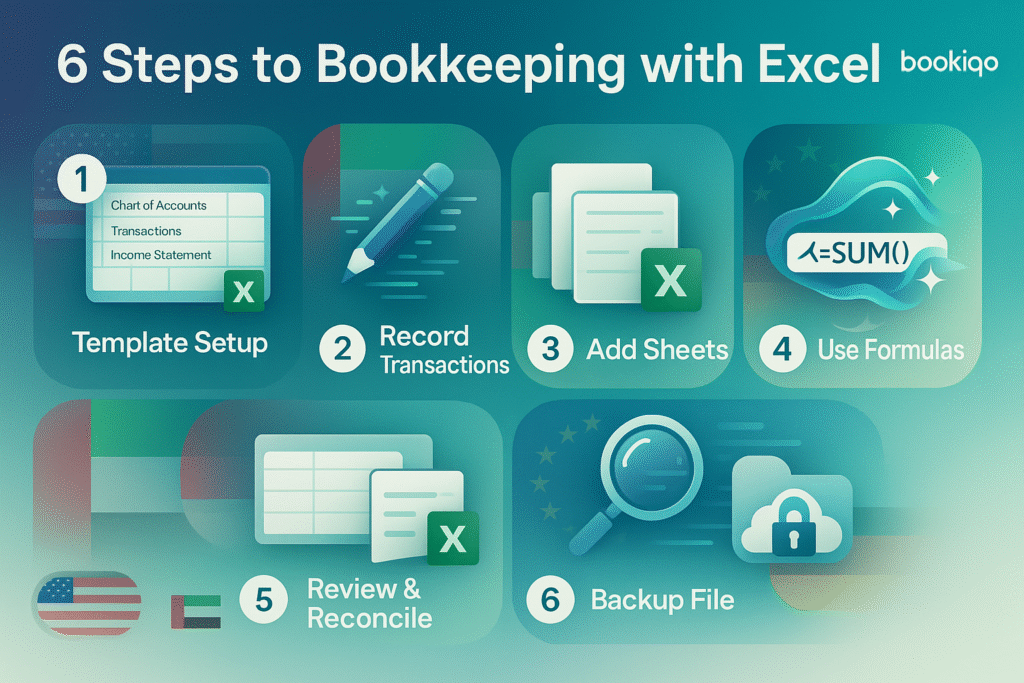

6 Steps to Bookkeeping with Excel

Step 1: Prepare a Bookkeeping Excel Sheet Template

Start with either a blank workbook or an Excel bookkeeping template. Your setup should include:

- Chart of Accounts – Categories for income, expenses, assets, liabilities.

- Transactions Sheet – Dates, descriptions, amounts, and categories.

- Income Statement Sheet – Summary of income vs. expenses.

This is the foundation of simple bookkeeping with Excel.

Step 2: Record Transactions Consistently

Every sale, purchase, payment, or receipt should be entered into your Excel sheet using categories from your chart of accounts. Consistent, accurate entries are the backbone of good bookkeeping tips in Excel.

Step 3: Create Additional Sheets if Needed

If your business grows, you can expand your workbook with sheets for invoices, expense breakdowns, or cash flow projections. For small business bookkeeping in Excel, this flexibility is a major advantage.

Step 4: Use Formulas and Functions

Let Excel do the heavy lifting. Built-in formulas like SUM, IF, and VLOOKUP can automate calculations and minimize manual errors. This is where Excel for financial record keeping really shines.

Step 5: Review and Reconcile Regularly

Compare your Excel records against bank statements to spot missing or incorrect entries. Regular reconciliation helps maintain the accuracy of manual bookkeeping in Excel.

Step 6: Save and Back Up Your File

Your Excel bookkeeping guide should end with a golden rule: protect your data. Save files securely, back them up in the cloud, and keep versions for safety.

Pros of Bookkeeping with Excel

- Cost-Effective – Often already included in Microsoft Office.

- Ease of Access – Familiar interface for most users.

- Customizable – Create a simple bookkeeping system that fits your needs.

- Powerful Tools – Formulas, charts, and formatting at your fingertips.

- Full Control – You decide how data is entered and structured.

(Keywords: Advantages of Excel bookkeeping, Excel bookkeeping for beginners)

Cons of Bookkeeping with Excel

- Error-Prone – Manual data entry risks mistakes.

- Time-Consuming – No automatic bank feeds or invoice imports.

- Limited Scalability – Not ideal for large, complex operations.

- Security Gaps – Lacks robust encryption.

- Weak Forecasting Tools – Hard to produce advanced reports.

(Keywords: Disadvantages of Excel bookkeeping, Manual bookkeeping Excel)

Example: Simple Bookkeeping Table in Excel

| Date | Description | Income ($) | Expenses ($) | Balance ($) |

| Aug 1, 2025 | Initial Balance | 5,000 | 5,000 | |

| Aug 5, 2025 | Product Sale | 700 | 5,700 | |

| Aug 10, 2025 | Rent Payment | 1,500 | 4,200 |

This Excel bookkeeping example shows how income and expenses flow, with the balance updated after each transaction.

When to Use Excel vs. When to Switch to Software

Small business bookkeeping in Excel is great for straightforward record keeping. But if your transactions grow, tax needs get complex, or you want automation, software like QuickBooks, Zoho Books, or Odoo may be worth the investment.

Final Tips for Effective Excel Bookkeeping

- Keep your entries up-to-date.

- Use clear, consistent categories.

- Backup regularly.

- Audit your data monthly.

By following these Excel bookkeeping steps, you can keep your finances organized and accurate without breaking the bank.

Conclusion

Bookkeeping with Excel remains a reliable choice for small businesses and self-employed professionals who want control and customization. While it has its limitations, a well-structured Excel system can handle the essentials — if you’re disciplined with updates and backups.

💡 Need a Custom Excel Bookkeeping Template❓

If you want an Excel bookkeeping template tailored to your business needs, we can design it for you. Call now to get your new Excel bookkeeping template and start managing your finances smarter.