Surprisingly, nearly 8 out of 10 businesses collapse primarily because of ineffective cash flow handling and poorly maintained financial records. Setting up proper bookkeeping from day one isn’t just about staying organized—it’s about keeping your business alive and thriving in today’s competitive marketplace.

Whether you’re launching a startup or transitioning from a side hustle to a full-time venture, understanding the fundamentals of business bookkeeping can mean the difference between success and becoming another statistic. This comprehensive guide will walk you through everything you need to know about establishing a solid financial foundation for your new business.

Table of Contents

Understanding Fundamental Bookkeeping Principles

The double-entry bookkeeping system records each business transaction twice, as a debit and a credit. This method makes sure everything adds up and helps catch errors.

Small businesses often start with cash accounting basics, recording money when it moves in or out. This simpler approach works well for new companies tracking basic income and expenses.

- Records provide financial data for making business choices

- Helps with tax filing and reports

Shows how your business performs over time

Choosing the Appropriate Legal Structure

When starting a business, you’ll need to choose your business structure. A sole proprietorship puts you and your business as one entity. An LLC keeps your personal assets safe, while partnerships let you share ownership.

The way your business is structured influences both your tax filings and the way you manage financial records. Consider these factors:

- How much legal protection do you need

- Which tax forms you file

- Whether you want business partners

- Your plans for business growth

Opening a Dedicated Business Bank Account

Opening a dedicated bank account for your business helps streamline your finances and simplifies tax preparation. You’ll need these items to open a business account:

- Business registration papers

- Tax ID number or EIN

- Formation documents

- Photo ID

Having a business account helps you separate your finances better and builds trust with customers. It also keeps your personal money separate, which protects you if legal issues come up.

Separating Personal and Business Finances

Keep your business money away from your personal accounts. Separate your personal finances and pay yourself a set amount each month. Make clear rules about when and how to pay back business expenses.

Track all business costs in your bookkeeping software choices. Save digital copies of receipts and label each expense properly. Look over your transactions weekly to catch any mixing of personal and business spending.

Good separation helps at tax time by:

- Making tax deductions clear

- Speeding up tax prep work

- Creating a clean record if the IRS asks questions

Selecting Suitable Bookkeeping and Accounting Software

Popular software options include QuickBooks, Odoo, Xero, Wave, and business bookkeeping software QuickBooks and Odoo works well for most small businesses, while Wave offers basic features at no cost.

- When picking software, think about:

- Your business size and money flow

- What reports you need

- Your budget

- How easy it is to use

- Ensure Compatibility with Your Other Business Tools

Good software helps by:

- Cutting down on typing mistakes

- Giving quick money updates

- Letting you work from anywhere

- Making sure all entries follow the same pattern

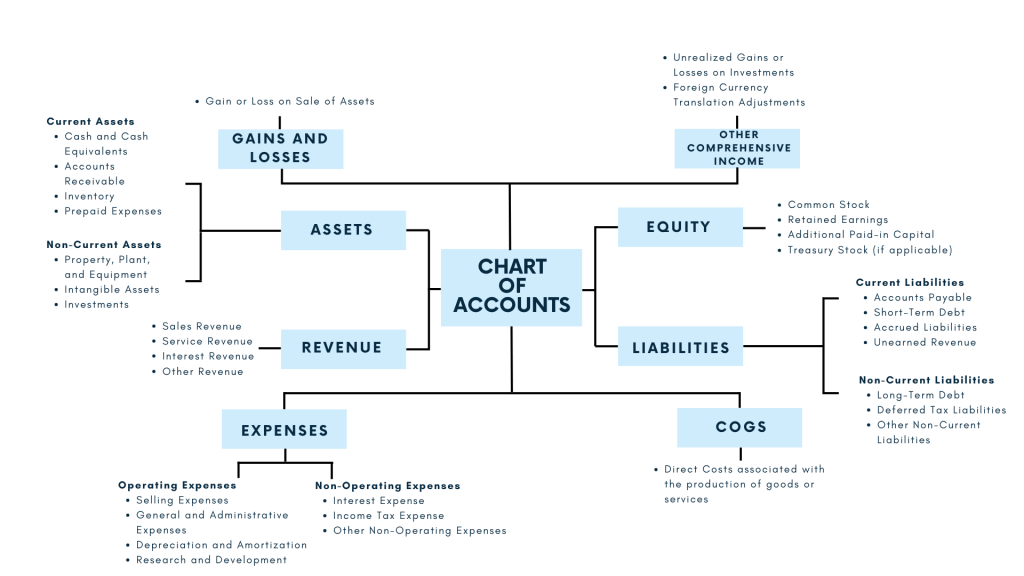

Building a Customized Chart of Accounts for Your Business

A chart of accounts lists all the categories you use to record money flowing in and out of your business. It helps you group similar items and create clear financial reports.

Start with basic accounting and add more as needed:

- Bank accounts and cash

- Money owed to you

- Equipment and supplies

- Credit cards and loans

- Sales income

- Day-to-day costs

Label each account clearly, like “Office Supplies” or “Client Payments.” Use numbers for each category – 1000s for assets, 2000s for money you owe, and so on. Keep it simple at first and add detail as your business grows.

Collecting and Organizing Required Supporting Documents

Keep these business records on hand:

- Sales invoices and payment slips

- Bills from suppliers

- Bank records and statements

- Tax papers and worksheets

- Business agreements

- Worker pay details

Store files with clear names by date and type. Use cloud storage like Google Drive to find papers quickly. Regularly Back Up Your Financial Data

Try these tools to manage papers:

- Scanner apps that read text

- Cloud folders that link to your accounting software

Digital filing systems with search options

Recording Financial Transactions Promptly and Accurately

To record business transactions properly, follow these steps:

1. Check source documents like receipts and invoices

2. Write down which accounts the money affects

3. Enter Key Details into Your Bookkeeping Framework

4. Link digital copies of receipts

5. Add notes about what the transaction was for

Quick recording helps you:

- Stay on top of your money flow

- Make better business choices

- Reduce tax time stress

- Spot money issues early

Watch out for these common slip-ups:

- Putting costs in wrong groups

- Missing small purchases

- Recording items twice

- Not checking accounts monthly

- Writing unclear notes

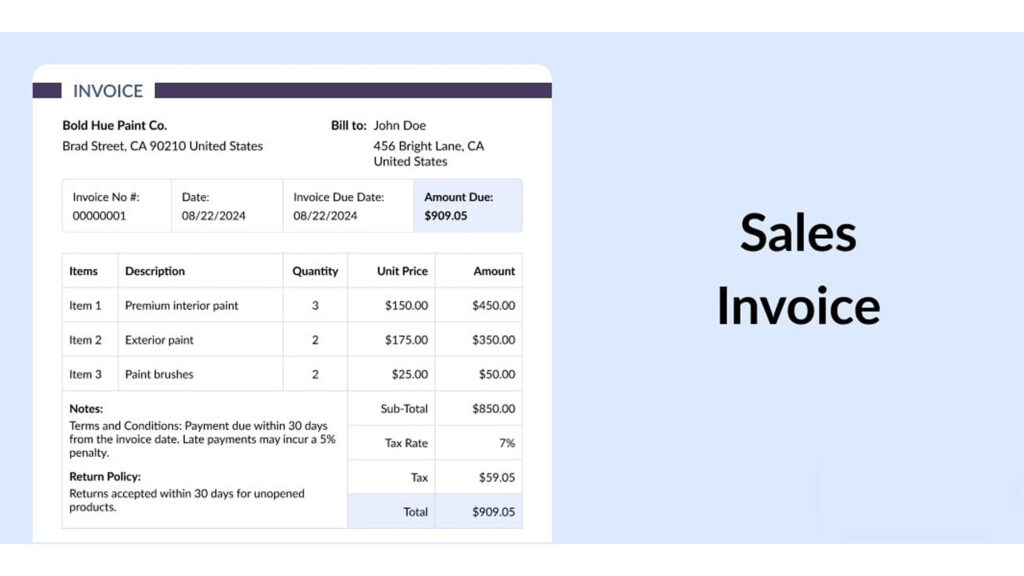

Issuing and Managing Sales Invoices

A good sales invoice needs:

- Your business name and contact details

- Customer information

- Invoice number for tracking

- Clear list of products or services

- Prices and total amount

- Payment terms

- Tax numbers when needed

Number your invoices in order and set regular times to send them. Monitor Outstanding Payments Using Aging Reports. Follow up on late payments with reminders.

When customers question an invoice:

- Write down all talks about the dispute

- Make clear rules for fixing mistakes

- Train staff how to handle issues

- Let customers pay the parts they agree with

- Stay professional in all communications

Tracking and Managing Expenses

Watch your business spending by sorting costs into tax-friendly groups. Set up rules for who can spend money and how much. Look at regular bills monthly to find ways to save.

Use these tools to track spending:

- Receipt scanner apps that connect to your accounting software

- Team expense report systems

- Credit card feeds that update automatically

- Reports that show spending patterns

Make budgets based on past spending data:

- Study old costs to plan future budgets

- Check actual spending against plans

- Make teams responsible for their budgets

- Plan for busy and slow times

Reconciling Bank Accounts Regularly

Carefully match each transaction in your bank statement with your accounting records to ensure accuracy. Mark items that match, find missing entries, and look into any differences. Include any bank charges or interest that haven’t yet been logged in your books.

Regular checking helps you:

- Catch bank errors quickly

- Find missing deposits or payments

- Keep your books accurate

- Spot any odd transactions

Make reconciling easier by:

- Setting a weekly or monthly schedule

- Using accounting basics explaination in your software

- Making a checklist to follow

- Writing down your process steps

Complying with Local Taxation Regulations

Each country has its own tax rules for businesses. In the UAE, most businesses don’t pay federal income tax, but they must charge 5% VAT on sales. Keep tax records for 5 years.

In the USA, businesses pay federal income tax based on their structure. Business owners make quarterly tax payments and collect sales tax in many states.

UK companies file yearly tax returns and VAT reports. They must follow rules and keep proper payroll records through PAYE.

In Germany, businesses are required to pay corporate tax, trade tax, and a standard VAT of 19%. They make monthly or quarterly advance payments and follow strict document storage rules.

Understanding and Meeting Financial Reporting Requirements

The UAE asks businesses to follow IFRS standards for financial statements. Large companies file detailed reports, while small businesses use simpler forms. Submit VAT returns every three months.

US companies follow these reporting rules:

- The type of business entity determines how and when you file your annual tax return.

- Quarterly tax payments

- State-specific yearly reports

- GAAP standards for bigger companies

UK businesses must:

- Send yearly statements to Companies House

- File VAT returns every quarter

- Submit tax returns and payroll data

- Update company details yearly

German companies need to:

- Follow accounting basics explained in Commercial Code rules

- Send tax forms online

- File VAT returns monthly or quarterly

- Print financial statements in the Federal Gazette

Maintaining Proper and Secure Records

Most businesses must keep accounting record for 5-10 years. Good records help prove tax write-offs and support loan requests. They’re also key if legal questions come up.

To keep financial data safe:

- Set up user passwords and access levels

- Store sensitive info with encryption

- Update security software regularly

- Back up records in two places

- Train workers on data safety

Make a record storage plan that:

- Groups papers by type and need

- Sets how long to keep each kind

- Lists safe ways to destroy old files

- Gets reviewed each year

- Tracks what gets thrown away

Scheduling Periodic Financial Reviews

Regular money reviews help spot problems early and guide your business choices. Look at your reporting flows like cash flow, unpaid bills, and costs monthly. Check profit reports and compare spending to your budget every three months. Do a full review yearly for taxes and planning.

Monthly tasks:

- Check bank balances

- Review unpaid customer bills

- Look at spending patterns

Quarterly work includes:

- Compare actual vs planned spending

- Study profit and loss reports

- Plan for upcoming taxes

Use these numbers to:

- Find areas to improve

- Spot low-performing products

- Make sales goals

- Track key business measures

Deciding Between In-House Bookkeeping or Outsourcing Services

When deciding whether to manage your bookkeeping internally or hire external support, consider the following factors:

- How many money moves your business makes

- What you can spend

- How complex your accounting activities are

- Who’s available to do the work

Managing bookkeeping internally provides hands-on control over your finances, but it often comes with higher expenses due to employee salaries and ongoing training needs. Outside help brings expert skills but might slow down quick questions.

Small startups do well with outside help until sales grow steady. Mid-size companies often mix part-time staff with outside tax help.

Preparing for Audits and Ensuring Audit Readiness

Make sure all your business records are organized and up to date before an audit begins. Check that all bank statements match your books. Make sure you have receipts and paperwork for major purchases and sales.

Basic audit items to gather:

- Bank records with matching statements

- List of money owed by customers

- Count of items in stock

- Records of business property and tools

- Tax payment proof

- Sales tax records

A simple self-check includes:

- Matching bank balances to your books

- Looking at old customer bills

- Counting physical items

- Checking loan amounts with banks

- Making sure worker tax forms are right

- Adding up sales tax collected

Seeking Professional Guidance or Hiring a Certified Bookkeeper

Get professional help when your business outgrows your money management skills or you need expert tax advice. A certified accountant/bookkeeper can step in when you’re getting ready for loans, having cash flow problems, or dealing with tax questions.

Working with a pro gives you:

- Expert help with complex money matters

- Smart financial planning tips

- Fresh eyes on your business health

- More time to run your business

- Fewer tax and compliance mistakes

Look for these qualities in a bookkeeper:

- QuickBooks or other software certification

- Work history in your field

- Clear pricing

- Good communication

- References from similar businesses

Implementing Bookkeeping Best Practices

Keep different records in Arabic and English for UAE businesses. Follow VAT rules carefully and save all papers from deals with companies outside the country. Watch the special rules for free zones.

For US companies, split sales tax by state. Write down why you spent money on business items. Keep mileage notes if you use a car for work. Make clear if workers are employees or contractors.

In the UK, use digital tax tools and follow VAT rules. List all business property and keep director loan records. Write down all business meal costs properly.

German businesses need special computer systems for tax records. Keep detailed sales papers for VAT. Follow cash register rules and save copies of everything.

Check and update your methods often. Train staff on new rules and get better at using your tools. Look at your software choices yearly to make sure they still work well.

Staying Updated on Regulatory Changes

Keep track of tax and business rule changes to avoid fines and missed deadlines. Regular reviews of bookkeeping and accounting newsletters help you spot new rules early.

Find updates through:

- Tax office websites and email lists

- Local accounting groups

- Software provider blogs

- Business news sites

- Your accountant’s updates

Rule changes might mean:

- Updating how you track money

- Getting new software tools

- Taking advantage of tax breaks

- Changing record storage

- Adjusting business plans

In Conclusion

Setting up proper bookkeeping for your new business might seem overwhelming at first, but breaking it down into manageable steps makes the process much more approachable. Remember that good financial record-keeping is not just about compliance—it’s about creating a clear picture of your business’s health and making informed decisions for growth.

Start with the basics, and gradually build your financial management system as your business grows. Don’t hesitate to seek professional guidance when needed, and always stay current with regulatory changes in your region. With these foundational elements in place, you’ll be well-positioned to manage your business finances effectively and sustainably.